Up to 10% APY on BTC

Put your Bitcoin to work.

Institutional yield strategies for serious holders. BTC native — your funds never leave the Bitcoin chain: no wrapping, no bridging, no protocol risks.

Finally, yield that doesn't demand you hand over control

Custodial products risk handing over your Bitcoin. Yields don't last. Until now, earning yield meant accepting risk and trade-offs you shouldn't.

So what’s the alternative?

The answer is here

Non-custodial Bitcoin yield with Cobault.

Deposit BTC. Earn up to 10% yield. In exchange, we cap your upside on price appreciation.

You maintain custody, earn steady yield, and profit regardless — even at the cap, you're ahead in USD terms.

Full control. Zero credit risk.

While staking, you and Cobault share cryptographic control via trustless multisig vaults. Cobault cannot move your funds unilaterally, eliminating counterparty, credit and custody risk.

Audits in progress

Code to-be open-sourced

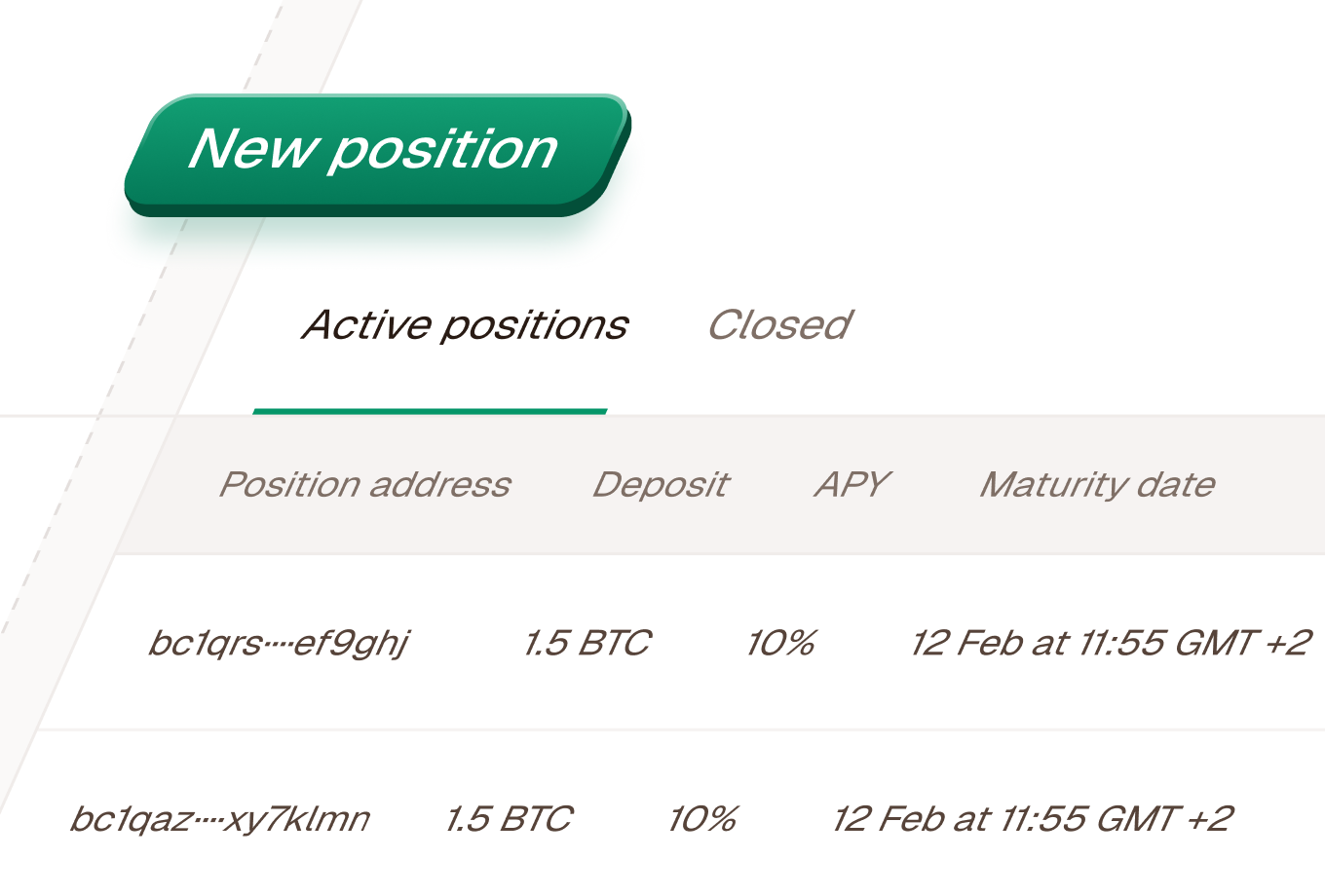

Simple. Quick. Transparent.

Open a position for up to 10% APY with a BTC Price Cap and a fixed maturity.

Deposit and wait. Deposited funds are SAFU, secured with multisig.

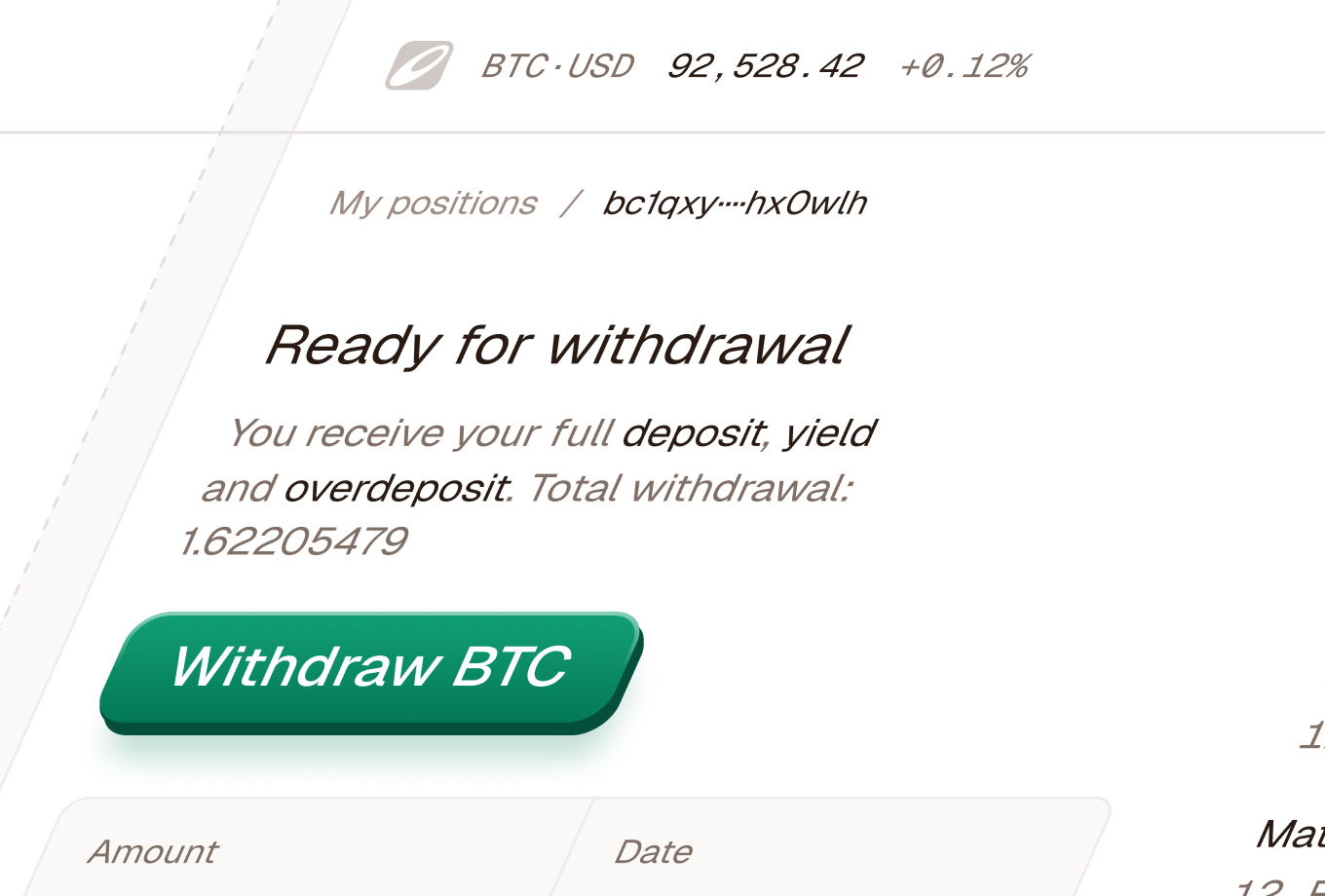

At maturity, get paid your yield and withdraw your BTC from your vault. Go again to keep earning yield.

Team

By people who’ve built markets.

Decades of banking, trading, technology and blockchain experience — with a global outlook and scope.

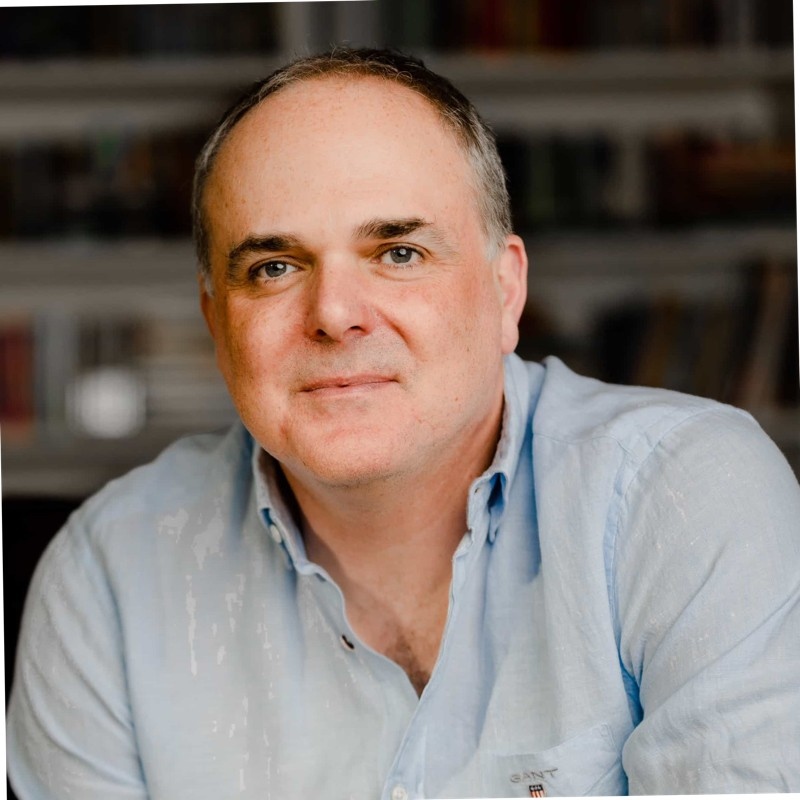

Jim Turley

Executive Chair

UK/EU

As global Head of Foreign Exchange and Money Markets and subsequently Head of Institutional Sales Jim has significant front office experience. Uniquely, Jim was also Global Co-Head of Technology & Operations, giving him unique insight into post-trade infrastructure. Jim also has extensive blockchain and digital asset experience as Founding Chairman of Finality (the UK wholesale CBDC) and board member of copper.co

Rashid Hoosenally

Chief Product Officer

UK/EU

Rashid is the Former Head of FX Sales and Global Head of FICC Structuring at Deutsche Bank, leading product innovation and development across the currencies, commodities and fixed income businesses. Rashid has over 6 years of blockchain expertise as co-founder and CEO of Guardian Labs.

Richard McLaren

Chief Operating Officer

APAC

With experience across blockchain and conventional financial markets, Richard led technology for Macquarie Mortgages, moneysupermarket.com and the Microsoft JV NineMSN. He has extensive experience building and supporting derivative pricing, risk and trading systems.

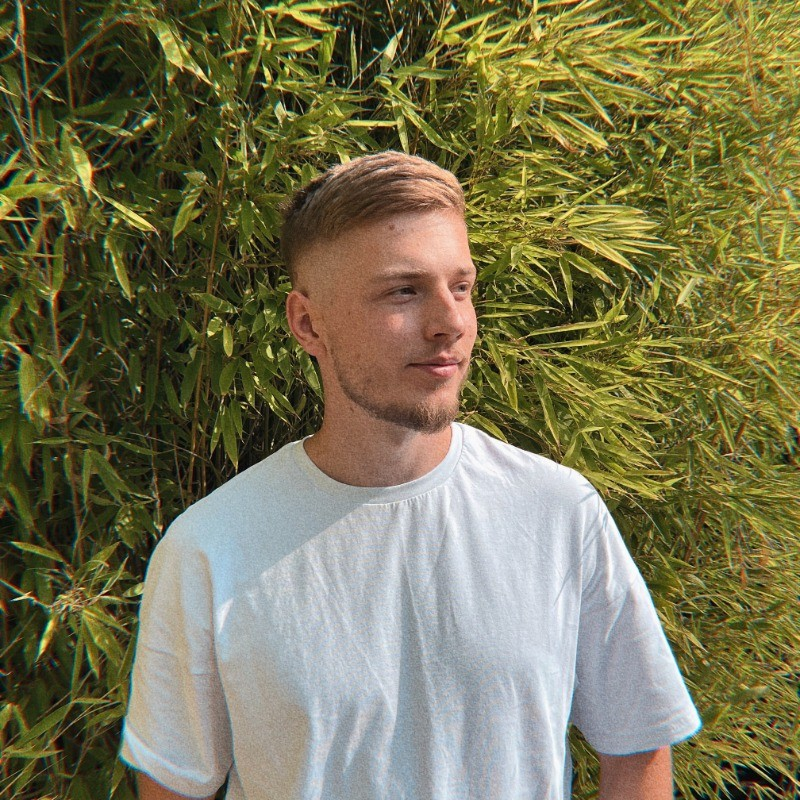

Sergey Nekrasov

Chief Product Officer

USA

Sergey is highly experienced across both cryptography, key management and smart contract deployment on blockchains. He pioneered Guardian’s Universal Policy Engine, that sits at the heart of its Control Layer and underpins Programmable Money and Compliance

Q2 2026

Early access program

Join the waitlist for updates, early access and potential rewards.

Ceiling & payout

Your payout depends on the price ceiling and BTC price at maturity date. Here’s an example:

Your deposit

1 BTC

APY

12%

Maturity period

20 days

BTC price ceiling

120,500 USD

Total yield

0.00658 BTC

If BTC price stays at or below the ceiling...

120,000 USD

If the price stays at or below the ceiling at maturity (after 20 days), you get your yield and deposit back in full.

Deposit

1 BTC

Yield

0.00658 BTC

Total

1.00658 BTC

Net profit

0.00658 BTC

If BTC price goes above the ceiling...

120,000 USD

If the price goes above the ceiling at maturity (after 20 days), you get the full yield in BTC, but deposit value is capped at the ceiling.

Example: BTC hits $120,500 at maturity. Capped deposit:

$120k ÷ $120.5k × 1 = 0.99585 BTC

Deposit (capped)

~0.99585 BTC

Yield

0.00658 BTC

Total

~1.00243 BTC

Net profit

0.00243 BTC